Yes Bank stock

analysis - Should I Buy or Sell or Hold Yes Bank

Introduction - Yes Bank Detailed Stock Analysis

The article offers a thorough Yes Bank stock

analysis, laying down the positive & the negative aspects of the bank.

YES

BANK is an Indian Private bank that offers personal banking, corporate banking

& internet banking services including accounts, deposits, credit cards,

home loan, personal loans, etc.

Recently

a report issued by Macquarie Capital, indicated

that there are chances that Yes Bank can see a substantial increase in stress

on asset quality in the upcoming quarters. Let us discuss the reasons behind

this and some positive developments in the bank’s case in this blog.

The

investors would get a clear picture of the stock after adequately analysing the

bank’s pre & post covid performance. A detailed Yes Bank fundamental

analysis is offered to the investors, indicating its corporate structure and

fundamentals.

Key Concerns - Yes Bank Performance Analysis

- The

Bank has large exposures to the real estate and hotel industry. These capital

intensive industries have suffered badly due to the COVID-19 crisis.

- This

can result in a substantial increase in NPAs over the next two quarters.

- Although

the Bank’s management claims that they have made enough provisions towards

their exposures in these two sectors, Macquarie reported that the bank could

see a surge in its bad debts and the bank would require to make more

provisions.

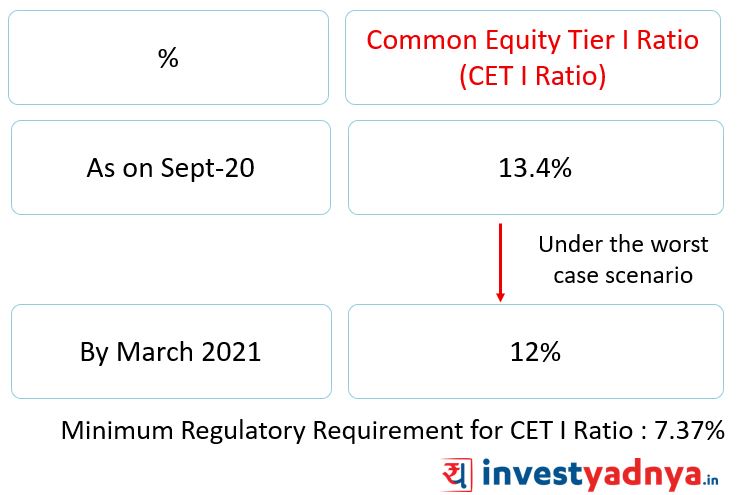

- Currently,

the bank’s tier1 common equity ratio (CET -1) is ~13.4% as on Sept’20, and it

might go below 12% by Mar’21. However, management is confident that it won’t

dip below 12%.

Key Positives - Yes Bank Stock Analysis Report

1. Changes in Corporate Structure

- Bank

has made a clear demarcation between risk and business in its new structure. MD

& CEO is now no longer a part of the credit committee. Credit Committee is

a committee that overlooks the process of disbursal of loans.

- Also,

the Bank is considering business and credit quality checks of the counterparty

before underwriting loans.

- The

head of risk and compliance would now report to the board, instead of

management. Thus, the board is more actively involved in critical decision

making.

2. Improving Business Outlook - Yes Bank Performance

- New account openings in the bank per month have almost doubled from the pre-COVID levels and the bank is targeting new account openings to the tune of 1 lakh per month.

- This is possible mainly as the bank is offering attractive interest rate of 6.5% on deposits which is way higher than its peers.

Conclusion - Yes Bank Analysis

There

are some signs of recovery for the bank with improving corporate governance

practices and business outlook. However, it is important to look at how the NPA

situation turns out in a few upcoming quarters post moratorium.

We

offer many resources on Yes Bank, facilitating the users to make a viable

investment decision. You can check our stock article on Yes Bank FPO Review,

which offers a thorough analysis of the bank. You can check out the latest Yes

Bank stock price along with its financials on the stock-o-meter

feature on our website.

Make

all your investment decisions with us, as we offer quality financial advice.

For more of such quality content, check out Invest Yadnya.