Dynamic Investment approach

Strategic and long-term fundamental approach with tactical views on economy & markets to provide a diversified asset allocation strategy to balance risk and return

Easily search Stocks, Mutual Funds, Articles and Videos

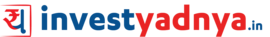

Stocks

Mutual Funds

eBooks

Articles

Videos

Stocks

Mutual Funds

eBooks

Articles

Videos

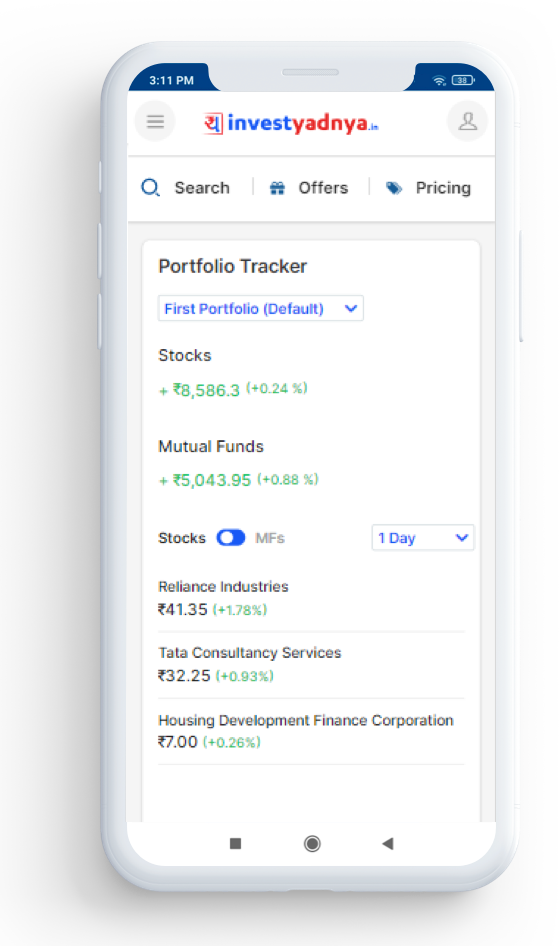

Ready-made portfolios (stocks & mutual funds) selected and periodically reviewed by our experts

Why Yadnya's Model portfolio is Different?

You can now invest in Model Portfolio directly.

Designed to make it easier for investors, these portfolios offer long term growth with a choice of Stocks, Actively managed Equity Funds, Index Funds/ETFs and Debt Funds. Portfolios are created separately for different risk profiles - Conservative, Moderate and Aggressive.

Selected and managed with input from the team who brought you Fund-O-Meter and Stock-O-Meter, whose research and information has made them a popular choice with investors. Full details of our methodology, including how the model portfolios are constructed and managed, can be found here.

Asset allocation, stock &

fund selection based

deep research

Investment across assets-

direct stocks, equity

funds & debt

Ability to choose from

different risk profiles which

suits you best

Monthly monitoring of

portfolios & quarterly

rebalancing

Strategic and long-term fundamental approach with tactical views on economy & markets to provide a diversified asset allocation strategy to balance risk and return

A portfolio of actively managed funds, index funds/ETFs and stocks for conservative risk taking investors

Model Portfolios are ready-made portfolios created by our Research team. These portfolios are created based on our Fundamental Analysis based research of Stocks & Mutual Funds with the Long Term investing view. We share complete research of each Stock and Mutual Fund suggested in the portfolios. We also give complete entry and exit reasons for each stock and mutual Fund in the specific model portfolio. These portfolios are regularly monitored by our research team and changes are done along with a complete analysis and transparent view.

Please Find the DEMO video which will guide you on how it works - https://youtu.be/P9_sCoXmc5E

Yes , Recently we have launched the execution platform for hassle-free Investments journey, Once you log in you find the INVESTNOW button from where you can Invest through your respective broker accounts from Yadnya's website.

Click here to check the detailed Video on " How to Invest in Model Portfolios?" - https://youtu.be/ucH8HbOVyFs

Yes, you can invest through multiple broker accounts. Which will help your family member to invest in the same portfolio without having a separate Model portfolio Subscription.

Click here to understand "How to Invest with Multiple Broker Accounts? " - https://youtu.be/9KIeWszjNx4

Yes, Now we have launched the One-Click hassle-free Rebalancing option. Where you will find the Re-balancing TAB on our website and with 2 steps you can re-balance the portfolio.

Click here to understand "How to do One-Click Rebalancing for the Invested Portfolios through Smallcase?" - https://youtu.be/9fPEp8DZ-Jg

Yes, you can set up SIP in the portfolios, this will be the first time we have introduced the option to do SIP in Stocks.

Click here to understands" How you can do the SIP in Portfolios " - https://youtu.be/JPRJWd8NYfM

Yes

Past performance of the portfolio along with the benchmark is given in respective Methodology Document

Complete details about the portfolios are given in their respective Methodology Documents. It will help you identify the right one for you. We do not give any personalized advice as part of this subscription.

All the portfolios are rebalanced regularly (quarterly/bi-annually) and detailed review is done by our research team. Next review dates are mentioned in Methodology documents. Portfolios are regularly monitored and changes are done even between rebalancing dates based on any major news or event.

Yes, you can comment on the articles OR you can also chat with our support team through 'Talk to us' option in our Android & iOS app. We also conduct regular Live Sessions with our management team.

Yes, we provide the Exit points of the stocks from our Portfolios along with the reason of Exit and change. Email & App notifications are sent for every change.

No, you will get access to research of Model portfolio Stocks only.

Yes, we do have Mobile App on Android & IOS which can give you easy access and Mobile Notifications

Being a Research product wherein you get access to all the stock videos and Mutual Fund research associated with Model Portfolios, we don’t have any Refund policy currently.

One of the most important things to consider while building your model portfolio investment is your personal risk tolerance. Other than that, some other things to keep in mind while building a portfolio are deciding how much assistance you need. Always choose your investment based on your risk tolerance, decide on an account that works towards your goals, and last but not the least- determine the trusted asset allocation for yourself. Learn how to build an investment portfolio for beginners with MF Yadnya!

Building an investment portfolio is very important during your investment phase because it allows you to keep track of the highs and lows and maintain a balance. The best way to build a strong investment portfolio in India is to follow these simple steps in portfolio construction: Decide on how much help you want, Choose your investment based on your risk tolerance, Decide on an account that works towards your goals, and Determine the best asset allocation for you.

If you are an investor who prefers to carry out hands-off kind of investment plans that are guided by professionals, in that case, a managed portfolio or investment portfolio management is the ideal choice for you. Typically, you select a portfolio that is specifically designed for your risk tolerance level. Still, you don’t have to spend your quality time researching and choosing individual investments or rebalancing your assets when hiring a professional. Enjoy effective financial portfolio management with Invest Yadnya.

For DIY investors, investment portfolio analysis is a very crucial task that should not be ignored at any cost. This critical process of portfolio analysis can be easily carried out by following six necessary steps. First of all, Upload your Portfolio on the Investment tracking tool by Investyadnya, then carefully evaluate your stocks and bond allocation. The next step is to assess the stock allocation and evaluate your bond allocations Specific funds, and lastly, determine advisor fees. Carry out portfolio analysis in investment management with Invest Yadnya!

The investment portfolio collects your assets and investments like stocks, bonds, mutual funds, and exchange-traded funds, which is an essential element while investing. Contrary to popular belief, a managed portfolio is a useful tool worth investing in. Especially if you are the hands-off kind of investor who carries out investment plans guided by professionals, then investment portfolio management is a must for you. This is because you select a portfolio designed for your risk tolerance level that the professional can analyse and offer you investment plans according to it.

Stock analysis is a method for investors and traders to make buying and selling decisions. By studying and evaluating past and current data, investors and traders attempt to gain an edge in the markets by making informed decisions.There are two basic types of stock analysis: fundamental analysis and technical analysis.

Fundamental analysis concentrates on data from sources, including financial records, economic reports, company assets, and market share. To conduct fundamental analysis on a public company or sector, investors and analysts typically analyze the metrics on a company's financial statements - balance sheet, income statement, cash flow statement, and footnotes. When running stock analysis on a company's financial statements, an analyst will usually be checking for the measure of a company's profitability, liquidity, solvency, efficiency, growth trajectory, and leverage. Different ratios can be used to determine how healthy a company is.

The second method of stock analysis is technical analysis. Technical analysis focuses on the study of past market action to predict future price movement. Technical analysts analyze the financial market as a whole and are primarily concerned with price and volume, as well as the demand and supply factors that move the market. Charts are a key tool for technical analysts as they show a graphical illustration of a stock's trend within a stated time period.

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. These investors may be retail or institutional in nature. Mutual funds have advantages and disadvantages compared to direct investing in individual securities. The primary advantages of mutual funds are that they provide economies of scale, a higher level of diversification, they provide liquidity, and they are managed by professional investors.

A financial plan may contain prospective financial statements, which are similar, but different, than a budget. Financial plans are the ENTIRE financial accounting overview of a company. Complete financial plans contain all periods and transaction types. It's a combination of the financial statements which independently only reflect a past, present, or future state of the company. Financial plans are the collection of the historical, present, and future financial statements;

Look no further than our new model portfolios. Designed to make it easier for investors, these portfolios offer long term growth with a choice of Stocks, Actively managed Equity Funds, Index Funds/ETFs and Debt Funds. Portfolios are created separately for different risk profiles - Conservative, Moderate & Aggressive.