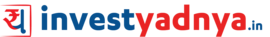

Easily search Stocks, Mutual Funds, Articles and Videos

Stocks

Mutual Funds

eBooks

Articles

Videos

Stocks

Mutual Funds

eBooks

Articles

Videos

Annual Subscription is available at the price of Rs. 999.00 only, with full access of all the information.

Financial Planning is the long-term process of wisely managing your finances to help achieve your Financial Goals, while at the same time negotiating the financial barriers that inevitably arise in every stage of life. Remember, Financial Planning is a process, not a product. Financial Planning is the process of developing a personal roadmap for your financial well being. The inputs to the Financial Planning process are:

The output of the Financial Planning process is a personal financial plan that tells you how to use your money to achieve your goals, keeping in mind the crucial aspects such as inflation, expected returns and taxes.

FinPlanYadnya is a DIY (Do-It-Yourself) Knowledge Bank or say a Knowledge Book of Financial Planning. It is a one-stop-shop for complete process, all queries and templates/calculators required for personal Financial Planning.

Now, more than ever, planning is the essential first step towards financial well-being. A good Financial Plan along with sound financial advice can help to make your financial future more manageable and finplanyadnya helps you in both – making a Financial Plan and giving you right financial advice.

Following are its key features –

Do you have any of these questions in your mind?

If you have any of the above questions in mind, then you need FinplanYadnya It helps you solve these and many more such financial queries you may have.

Money management or Financial Planning is not a rocket science and you don’t need a financial degree to do it. You only need a basic knowledge and little commitment.

FinPlanYadnya takes you through complete journey of Financial Planning, which would make you capable of understanding the basics and will guide you further to your Goals achievement. The concepts are created in simple language, keeping a layman in mind. It also contains lots of examples and infographics. It helps you in –

All the topics which are necessary for understanding your money, creating your Financial Plan, implementing it and reviewing it and doing complete money management are covered in this Knowledge Book. Here is the list of main topics which are covered -

You may please click here at FinPlanYadnya to see a detailed Content Index.

Yes, it is updated regularly, weekly updates are published on the portal/ app. and these updates will also be rolled out via emails regularly to the subscribers. Following are various types of updates -

We have uploaded and will keep uploading new Calculators and Templates for various calculation purposes. All the Calculators & Templates are in MS Excel or MS Word format. You can simply download them from our library or from our specific article and insert your numerical details and get the easy access to the calculated solutions and create your own Financial Plan. Some of such calculators and templates are:

This knowledge book was NOT built from perspective of passing CFP (Certified Financial Planner) or RIA (Registered Investment Advisor) exams. But we have come across many students who find this book very simple to understand and have helped them a lot in passing these exams due to easy to understand examples, simple language and updated information.

But please remember, this book alone may not be enough. You may use it as a reference book.

Yes, lot of information is available on web, but it is all scattered in different websites. Many of these websites are global websites with information not too relevant to India. Here are the reasons, why you should subscribe to FinPlanYadnya -

There is no website or application which gives you Financial Planning information in such structured way and gives all information at one place. There are CFP (Certified Financial Planner) and RIA (Registered Investment Adviser) study materials available at much higher cost but they are built from the perspective of passing the exam and not for helping an individual to create his/her own Financial Plan.

FinPlanYadnya is a very structured & process oriented knowledge bank which gives all the information at one place. All the information is created by keeping Indian geography in mind.

We have provided the content in simplest manner and have explained it with lots of examples, infographics, takeaways and videos. We keep on updating our content as well as rolling out new articles and calculators and case studies, for your understanding. We have also explained various cases citing examples for understanding the calculations and logics. All the content is created by SEBI registered RIAs and is based on vast experience in Financial Planning field by our founders.

You may also suggest us the topics, by writing to us at [email protected]. We will write on your suggested topics.

Stock analysis is a method for investors and traders to make buying and selling decisions. By studying and evaluating past and current data, investors and traders attempt to gain an edge in the markets by making informed decisions.There are two basic types of stock analysis: fundamental analysis and technical analysis.

Fundamental analysis concentrates on data from sources, including financial records, economic reports, company assets, and market share. To conduct fundamental analysis on a public company or sector, investors and analysts typically analyze the metrics on a company's financial statements - balance sheet, income statement, cash flow statement, and footnotes. When running stock analysis on a company's financial statements, an analyst will usually be checking for the measure of a company's profitability, liquidity, solvency, efficiency, growth trajectory, and leverage. Different ratios can be used to determine how healthy a company is.

The second method of stock analysis is technical analysis. Technical analysis focuses on the study of past market action to predict future price movement. Technical analysts analyze the financial market as a whole and are primarily concerned with price and volume, as well as the demand and supply factors that move the market. Charts are a key tool for technical analysts as they show a graphical illustration of a stock's trend within a stated time period.

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. These investors may be retail or institutional in nature. Mutual funds have advantages and disadvantages compared to direct investing in individual securities. The primary advantages of mutual funds are that they provide economies of scale, a higher level of diversification, they provide liquidity, and they are managed by professional investors.

A financial plan may contain prospective financial statements, which are similar, but different, than a budget. Financial plans are the ENTIRE financial accounting overview of a company. Complete financial plans contain all periods and transaction types. It's a combination of the financial statements which independently only reflect a past, present, or future state of the company. Financial plans are the collection of the historical, present, and future financial statements;

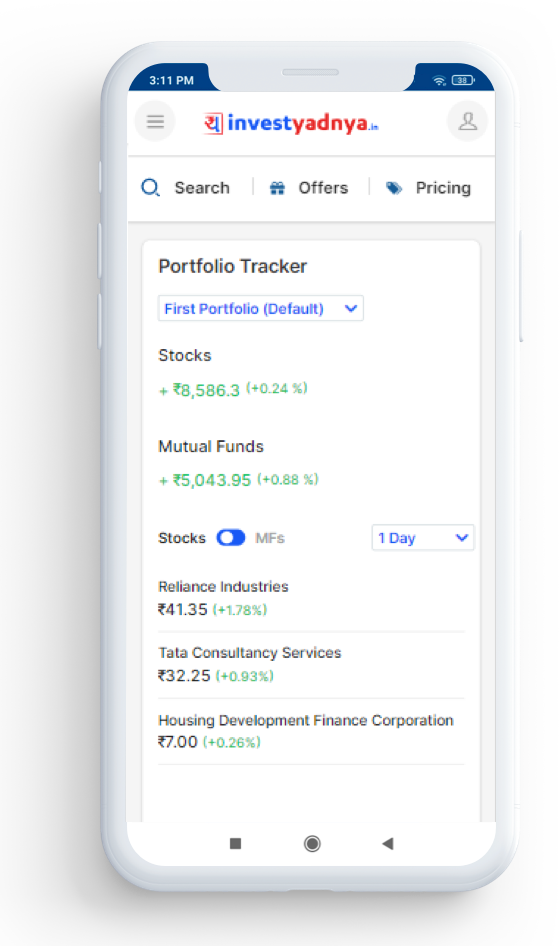

Look no further than our new model portfolios. Designed to make it easier for investors, these portfolios offer long term growth with a choice of Stocks, Actively managed Equity Funds, Index Funds/ETFs and Debt Funds. Portfolios are created separately for different risk profiles - Conservative, Moderate & Aggressive.