In this article, we will be discussing the Nifty Midcap 150 Quality 50 Index, what is it, and how it works. Should You Invest? Get all your answers about this Index in the article, so, let’s get started.

Nifty Midcap 150 Quality 50 Index:

- The Nifty Midcap150 Quality 50 index includes the top 50 companies from its parent Nifty Midcap 150 index, selected based on their ‘quality’ scores. NIFTY Midcap 150 Quality 50 index is a child index as constituents of this index selected from a list of NIFTY Midcap 150 index

- 50 companies with higher profitability, lower leverage, and more stable earnings are selected to be part of the index

- The quality score for each company is determined based on return on equity, financial leverage (except for financial services companies), and earning per share (EPS) growth variability of each stock analyzed during the previous 5 financial years.

- The weight of each stock in the index is based on a combination of the stock’s quality score and its free float market capitalization.

- Each stock in the index is capped at the lower of 5% or 5 times the weight of the stock in the index based only on the free float market cap

Selection Criteria:

- Stocks should form part of the Nifty Midcap 150 index at the time of review

- Constituents should have a minimum listing history of 1 year

- At the time of index reconstitution, a company that has undergone a scheme of arrangement for a corporate event such as spin-off, capital restructuring, etc. is considered eligible for inclusion in the index if the company has completed twelve calendar months of trading

Stock Selection Criteria:

- For each eligible stock, the Z score is calculated based on return on equity (ROE), debt-to-equity (D/E) ratio, and EPS growth variability in the previous 5 years. The debt-to-equity ratio is not considered for companies belonging to the financial services sector

- The latest fiscal year data is considered for the calculation of return on equity (ROE) and debt-to-equity (D/E) ratio. EPS growth variability in the previous 5 financial years is calculated using adjusted EPS of the previous 6 years. Consolidated financial data is used wherever available else standalone financial data is taken into consideration

- EPS growth variability is not calculated for stocks with negative EPS in any of the previous 6 fiscal years. Such stocks are not considered for selection

- In case of an IPO, the company will be considered for selection, if adjusted EPS data is available to at least calculate EPS growth variability in the previous 3 financial years

- Weighted average Z score is calculated for all securities, quality score is calculated and the top 50 stocks are selected based on the quality score

Reconstitution & Rebalancing:

- Index rebalancing will be done on a semi-annual basis in June and December.

- At the time of review, stocks forming part of Nifty Midcap 150 are eligible to form part of this inde

- Top 25 ranked stocks based on the quality score are compulsorily included in the index, whereas existing stocks in the index whose rank goes beyond 75 are compulsorily excluded from the index

- Apart from the scheduled semi-annual review, additional ad-hoc reconstitution and rebalancing of the index shall be initiated in case any of the index constituents undergo suspension or delisting or scheme of arrangement

Recent Changes- June 2022:

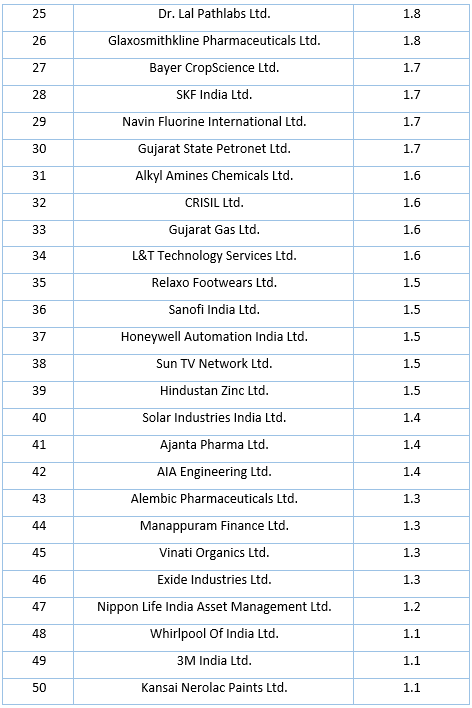

Index Constituents:

- The Top-10 Stocks constituents 31.4% and Top-25 stocks constituents 63.6%.

Sector Allocation:

- This Index is having highest allocation to the Chemical Sector i.e., 18.7% which is followed by the Healthcare Sector which is having an allocation of 16.6% of the index. The fund is having least allocation of 2.4% in the Automobile sector.

Returns:

- Calendar year returns are above category average for 5 out of 10 times. For the rest of the period, the returns of the index are at par average mostly.

- Trailing returns have remained muted overall where the last 1-year return has turned negative against higher single-digit positive returns from the benchmark and category average.

- The last 3-year returns have remained lower than benchmark and category and in the 5 years, it is at par with benchmark returns.

- In terms of Rolling Return too, in every factor, the Nifty Midcap 150 Quality 50 Index has outperformed the category average in every case.

Risk Ratio:

- The standard deviation of this index is around 23% whereas the standard deviation of the Nifty Midcap 150 is around 28%.

- The beta of this index is lower than 1 at around 0.7.

- The index has also generated Alpha quite very well. PE is more than Nifty Midcap 150.

How to invest in this index?

There is 3 option available to invest in this index:

What should investors do?

Overall, this Index Fund/ETFs has performed very well as compared Nifty 150 index. It is Index/ETF focused on Nifty Midcap 150 stocks that too with a quite qualitative and less risky investing approach and hence investors with a low-risk appetite can keep this index on their radar, one can choose it according to their risk-taking appetite and return expectation.

Disclaimer: The information here is provided for reference purposes only and should not be misconstrued as investment advice. Under no circumstances does this information represent are commendation to buy or sell stocks or MF.

Originally Published On:https://blog.investyadnya.in/what-is-the-nifty-midcap-150-quality-50-index-how-does-it-work-should-you-invest/