With post-pandemic economic recovery in full swing, the performance of Titan Company Limited witnessed a sharp improvement. The company has some aggressive expansion plans that cover the domestic and international markets, and an aim to have 700 stores over the next couple of years. How will this expansion pan out for shareholders?

Gold, silver, diamonds and similar other precious ornaments generally reward the holder with a return closer to inflation over the longer term. But some principled companies dealing in such jewels have given good returns to investors more, often at a rate higher than inflation over the same period. One such company that has posted gradual and consistent returns is Titan Company Limited. Titan is spreading its wings internationally after a successful domestic run. Let us examine its domestic performance and its expansion goals.

Titan Company Limited, an Indian listed entity, is primarily engaged in the manufacturing and selling of jewellery and has also penetrated into segments such as watches, eyewear, sarees, Indian wear and accessories & products. As of the end of Q1 FY23, it had 2,303 stores with a total retail area of more than 2.9 million sqft under operations, with a presence in 366 towns, 10 manufacturing and assembly facilities and around 9,500 employees.

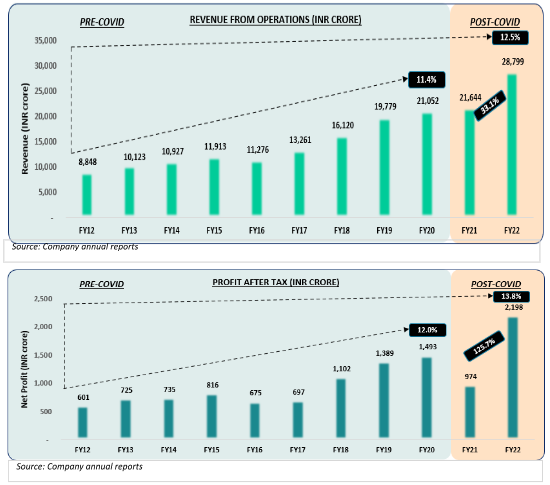

In FY22, amid various challenges such as the second and third Covid waves and global conflicts, Titan earned a revenue of Rs 28,799 crore, showcasing a YoY growth of 33.1% (over a Covid disrupted lower base of FY21). During the same period, the YoY growth in profit after tax (PAT) was 125.7%. The annual report of FY22 indicated reasons for such robust growth, including strong demand across all its business verticals and strong recovery in demand after the second wave, as more stores were fully operational with overall store operation days exceeding 90% for the second quarter of FY22. Management indicated that the premiumisation of brands, the launch of new products and stores, certain digital initiatives driving online sales growth, and the bounce back in consumption and retail sales, especially during the festive season, are some of the key factors that aided in exceptional sales and financial performance.

Titan posted robust Q1FY23 results with revenue from operations of Rs 8,975 crore (sale from product & services) and a PAT of Rs 790 crore. Revenue grew by 24% sequentially on a QoQ basis, and net profit increased by 50% during the period. Sales growth was driven by both buyer and ticket sizes and disruption-free Akshay Tritiya during the Q1 gone by. EBIT margins improved on the back of operating leverage gains and improved product mix.

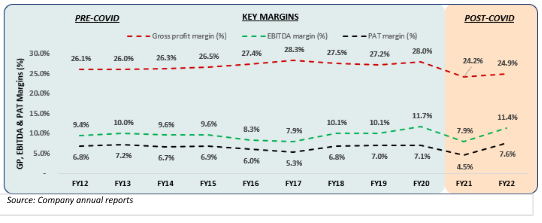

In the last 10 years, the company’s revenue increased by a CAGR of 12.5% per annum, whereas PAT has increased by a CAGR of 13.8%. Over the years, Titan has experienced economies of scale in certain fixed expenses such as advertisement, miscellaneous expenses and others, including professional expenses. In contrast, the selling and distribution cost as a percentage of sales has increased, while employee cost has remained range-bound. Backed by such numbers, during this period of 10 years, the stock price rewarded a CAGR of more than 25%. Also, gross profit margin, EBITDA margin and PAT margins have shown range-bound behaviour during the period.

For Q1FY23, EBITDA margin, PAT margin and gross profit margin showed even better performance at 13.6%, 8.7% and 26.8%, respectively.

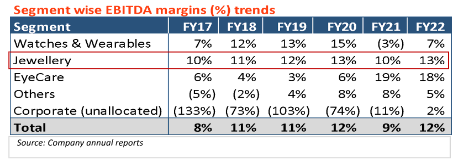

Titan is known to be a watchmaker of formal and fancy brands, including Fastrack. The total contribution to its top line from segments such as eyecare, watches and certain other products and accessories is merely 12% as of Q1 FY23. Therefore, even if these segments grow, their overall impact on the bottom line will not be much. Titan’s jewellery segment is a golden goose; it accounted for 88% of the total revenue as of Q1FY23.

The jewellery segment comprises brands such as Tanishq, Mia, Zoya and CaratLane. Mia and CaratLane are mid-market brands; Tanishq is premium and Zoya falls under the luxury category.

Titan has a relatively different operating model in gold transactions. It procures gold on a lease basis instead of buying it outright in the open market. This ensures that the company’s focus remains on its fundamental business operation of designing and selling jewellery, instead of getting bothered by gold price fluctuations impacting profitability.

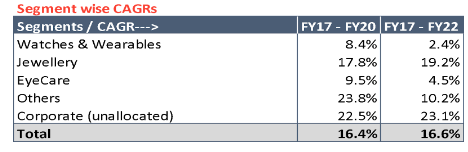

As set out in the above table, the top line CAGR of ~ 19.2% of the jewellery segment during FY17-FY22 and relatively stable and increasing margins in the jewellery business have been key growth drivers for Titan’s business in the last few years. The above two tables clearly indicate that the biggest growth driver for Titan has been the jewellery business.

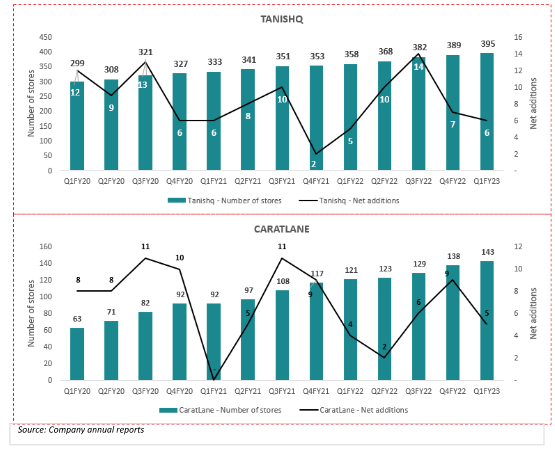

Steps undertaken by Titan to domestically strengthen its jewellery business include adding stores. In the last three years, it added around 102 stores under the Tanishq brand and nearly 83 stores under the CaratLane brand, taking the total store count to 389 and 138 as of FY22, respectively. Tanishq and CaratLane launched 6 and 5 new stores, respectively, during Q1FY23.

Growth in Number of Stores – Tanishq and Caratlane:

To expand its business operations internationally, Titan initially opened its first international Tanishq store in Dubai last year. This performed exceedingly well, after which more stores were opened in that geography. According to the Q1FY23 conference call, Titan has a very aggressive plan for the Gulf Cooperation Council (GCC) region; it has 3 stores in Dubai and is in process of opening the fourth one.

During FY22, Titan, via TCL North America Inc, its wholly owned subsidiary, acquired a minority stake of 17.5% in Great Heights Inc, a US-based entity operating in the diamond business, for an overall value of Rs 152 crore ($20 million) with nearly 40 lakh shares in exchange. For 2021, Great Heights Inc posted a revenue of $25 million, thereby making the acquisition at a price to sales of 0.8x. Titan would benefit from this investment by gaining access to fast-growing lab-grown diamonds and direct-to-the-consumer sectors. The acquisition is targeted to further strengthen the jewellery business, especially Tanishq.

Titan aims to become the jeweller of choice among non-resident Indians (NRI) and persons of Indian origin (PIO) markets. The management said the NRI/PIO audience celebrates Indian weddings, festivals and events with great zeal; and brand familiarity among that audience attracts target customers to the company’s stores.

The current per capita income of NRI/PIO in the US is $1,00,000 — against the country’s average of $65,000. This is expected to act as a tailwind for the company, in addition to the cultural attachment of the NRI/PIO audience to Indian jewellery. Titan management said the market was approximately $3-4 billion in size and very unorganised. The company expects to see a good response from here, similar to the Dubai stores. The management is looking at getting decent ticket sizes and a good share of the diamond jewellery segment.

Titan has aggressive plans for the US, according to the Q1FY23 conference call. The first store in North America would be opened in early FY23 and 2-3 outlets would be opened in the country in that year. The company would open 20 stores in the US over the next three years, with plans to expand if these see success.

There is a duty on gold in India. Therefore, it is cheaper for NRIs and PIOs to buy gold outside. As a result, Titan management said sales per store in Dubai or the US would be approximately double that of Indian stores. Therefore, if Titan opens 20 stores in the US or Dubai, that would technically mean that those 20 stores would yield a revenue equivalent to 40 stores in India.

As of FY22, on a consolidated level, merely 2% of Titan’s total income came from business outside India, showcasing a growth of 7.2% CAGR (FY17-FY22). According to the Q1FY23 conference call, the current share of international business is low and expected to increase in the next 2-3 years. In its annual investors and analysts meeting presentation dated May 13, 2022, the management said they expect to post a revenue of Rs 2,500 crore-plus from international business and become the brand of choice for the Indian diaspora in North America and West Asia by FY27.

Jewellery Industry (Global and USA)

Given that Titan is looking for expansion internationally, let us get an overall understanding of the estimated size and growth of the global jewellery industry.

According to a market analysis of the jewellery industry by Grandview Research, the global jewellery market size was $249 billion in 2021, and was expected to compound at a CAGR of 8.5% from 2022 to 2030. This would make the jewellery market size reach nearly $519 billion. Compared to the global jewellery market and growth, the US jewellery market was at $32.1 billion as of 2021. It was expected to grow by 7.6% CAGR from 2022 to 2030, reaching $62 billion. As of 2021, 61% of the jewellery market share is in Asia-Pacific, driven by large consumption in India and China.

The report listed the key factors expected to drive global growth in the jewellery market as increasing disposable income, innovative jewellery designs, customisation, jewellery being perceived as a Veblen product (as a status symbol), weddings as well as increasing jewellery demand among men for cufflinks, rings, chains and bracelets, among others.

As Titan has gained access to the lab-grown diamond industry after its acquisition, it is pertinent to understand the details of this industry. According to the International Gem Society, lab-grown diamonds (synthetic diamonds) comprise a small percentage of the total market. Demand for these has been increasing primarily because of two reasons: they are relatively cheaper than natural diamonds and there is greater awareness among buyers about the environmental problems that diamond mining can cause.

According to a report by Allied Market Research, the global lab-grown market size was valued at $19.3 billion in 2020, and expected to grow by 9.4% CAGR from 2021 to $49.9 billion in 2030. The report stated that the advantage of these diamonds was that they could be personalised.

A diamond takes billions of years to form naturally. But it can be grown in a lab within months.

Lab Grown Diamonds markets are segmented as follows:

Select Key Global Competitors

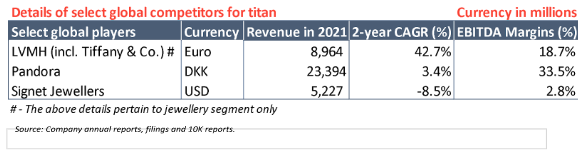

Titan’s expansion in the USA may see headwinds in the form of competition from dominant players. The key competitors include LVMH (which acquired Tiffany & Co in 2021), Pandora and Signet Jewellers.

LVMH operates in multiple segments, including fashion and leather goods, watches, and jewellery. Watches and jewellery are LVMH’s third largest segment, with revenue of Euro 8,964 million. Pandora is a Danish jewellery manufacturer and retailer engaged in making bracelets, rings, earrings, necklaces and watches. Signet is a prominent retailer of diamond jewellery.

Key Risks for Titan

A key risk for Titan includes the current account deficit (excess of imports over exports). India’s largest imports include oil and gold. Oil being an essential commodity and its import cannot be contained. Therefore, to maintain the balance of the current account deficit, the government’s only choice is to curb the imports of gold. For example, in 2013, the Reserve Bank of India issued a circular stating that companies cannot procure gold on lease, which impacted Titan’s core operations.

One must also note certain inherent risks for the company, such as time taken to break even in some segments. For example, Titan picked up a stake in CaratLane in mid-2016, which was expected to break even in FY20. Also, Titan Eye Plus, launched in 2008, was set for breakeven in 2013-14. Tanishq stores have a shorter break even period domestically.

In the Q4FY15 conference call, the management discussed the strategy around opening Tanishq stores in smaller towns. The company typically targets a throughput of around Rs 80,000 to Rs 1,00,000 per sqft for the first year and sets up stores in catchments. Whether it is a big city or small towns, based on the sales opportunity that catchment represents, the aim is to break even in approximately one or 1.5 years.

According to the Q1FY23 conference call, the breakeven period on an international store level would be good as domestic stores given good international scale economies, and on a business, level, breakeven may occur by the 3rd or 4th full year.

Certain key metrics are as follows:

Source: Ace Analyzer

It is indicative from these details that Titan has some aggressive expansion plans, including in international markets, to take the jewellery store count to 700 over the next couple of years. The company also expects brands such as Zoya & Mia to scale up in the next few years, backed by recent breakthrough momentum.

Other major plans include:

- Growing customer base by penetrating tier-2, -3 & -4 towns.

- Focus on making Tanishq a more robust brand in strategic markets such as Tamil Nadu, one of India's largest jewellery markets, by network expansions, cultural marketing, etc.

- Growing with a technological edge: Sales through video calls, omnichannel framework with the try-at-home feature, online shopping, etc, are certain key features that have been introduced.

- Growing presence through new format stores: CaratLane opened its 1st airport store in Bengaluru.

Given the expansion plans and the opportunities, investors should keep an eye on how Titan executes these plans in the face of competition and challenges.

Originally Published On:

https://economictimes.indiatimes.com/markets/stocks/news/how-titan-companys-expansion-plans-may-impact-its-margins/articleshow/93472972.cms