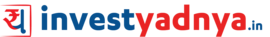

Easily search Stocks, Mutual Funds, Articles and Videos

Stocks

Mutual Funds

eBooks

Articles

Videos

Stocks

Mutual Funds

eBooks

Articles

Videos

Annual Subscription is available at the price of Rs. 999.00 only, with full access of all the information.

TaxYadnya is a Knowledge Bank or say a Knowledge Book of Income Tax in India. The concepts are explained in the most simplistic manner on Income Tax in India. It is always updated with latest Income Tax information. If you want latest Tax slab, latest EPF rates, latest Gift Tax rules, latest ITR forms, latest section 80D limits, etc. you will find it all here.

If you are an Individual tax payer, then TaxYadnya is for you. Since it is created with a layman in mind, its language is very simple. It explains all the complicated terms and sections in a very simple language with lots and lots of examples (100+ Examples), FAQs (500+ FAQs) and infographics (200+ Infographics). It helps you in –

Yes, it is updated regularly and Weekly updates are published on the portal/app. and the updates will also be rolled out via emails regularly to the subscribers.

All the topics which are needed by Individual taxpayers are covered in this Knowledge Book. Here are the main topics which are covered – Income Tax Basics, HUF, Section 80C, TDS, Other Deductions, Gift Tax, Real Estate, Other Allowances, Income Tax Calculations, Shares and Mutual Fund, Other Investments, Pension, Filing of ITR.

We have uploaded and will keep uploading new calculators for various calculation purposes. You can simply download them from our library or from our specific article and insert your number details and get the easy access to the calculated solutions.

It is available at the price of Rs. 999/year only, with complete access of information. Please click here to register.

You can write to us at [email protected], we will surely try to solve your Tax query. We are trying to build-in app query management system, but it will take some more time.

We have provided the content in simplest manner and have explained it with lots of examples and videos. We keep on updating our content as well as rolling out new articles and calculators, for your understanding. We have also explained various cases, citing examples for understanding the calculations and law. You may also suggest us the topic, by writing to us at [email protected]. We will write on your suggested topics.

Yes, most of the information is available but here are the reasons, why you should subscribe to TaxYadnya

There are some external CAs and Tax Consultants who help us in creating material for this Knowledge Book and we will be happy to connect you to them. Drop us an email at [email protected]

Our source of information is purely from the Income Tax Law and the Rules thereon. We have simplified the information, so that ordinary people can also understand the concept and applicability of Tax Law in India.

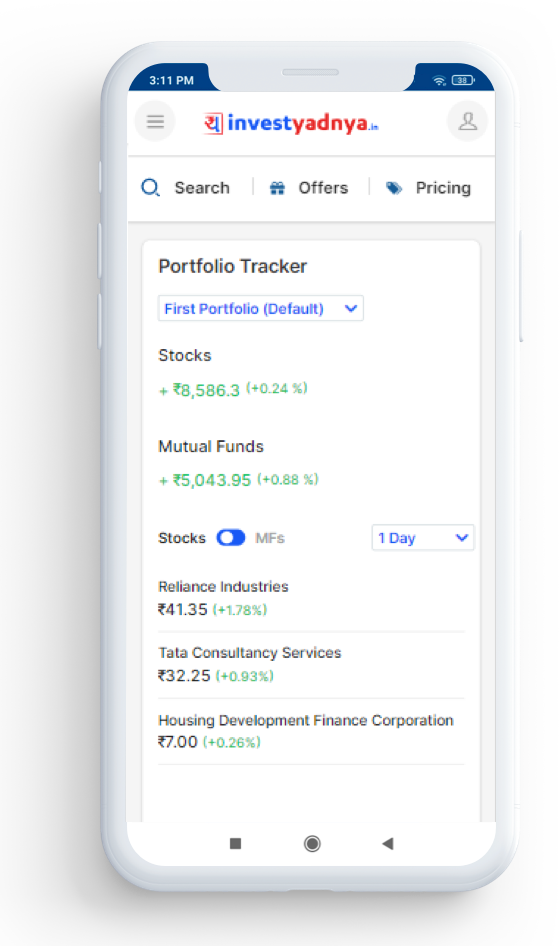

Stock analysis is a method for investors and traders to make buying and selling decisions. By studying and evaluating past and current data, investors and traders attempt to gain an edge in the markets by making informed decisions.There are two basic types of stock analysis: fundamental analysis and technical analysis.

Fundamental analysis concentrates on data from sources, including financial records, economic reports, company assets, and market share. To conduct fundamental analysis on a public company or sector, investors and analysts typically analyze the metrics on a company's financial statements - balance sheet, income statement, cash flow statement, and footnotes. When running stock analysis on a company's financial statements, an analyst will usually be checking for the measure of a company's profitability, liquidity, solvency, efficiency, growth trajectory, and leverage. Different ratios can be used to determine how healthy a company is.

The second method of stock analysis is technical analysis. Technical analysis focuses on the study of past market action to predict future price movement. Technical analysts analyze the financial market as a whole and are primarily concerned with price and volume, as well as the demand and supply factors that move the market. Charts are a key tool for technical analysts as they show a graphical illustration of a stock's trend within a stated time period.

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. These investors may be retail or institutional in nature. Mutual funds have advantages and disadvantages compared to direct investing in individual securities. The primary advantages of mutual funds are that they provide economies of scale, a higher level of diversification, they provide liquidity, and they are managed by professional investors.

A financial plan may contain prospective financial statements, which are similar, but different, than a budget. Financial plans are the ENTIRE financial accounting overview of a company. Complete financial plans contain all periods and transaction types. It's a combination of the financial statements which independently only reflect a past, present, or future state of the company. Financial plans are the collection of the historical, present, and future financial statements;

Look no further than our new model portfolios. Designed to make it easier for investors, these portfolios offer long term growth with a choice of Stocks, Actively managed Equity Funds, Index Funds/ETFs and Debt Funds. Portfolios are created separately for different risk profiles - Conservative, Moderate & Aggressive.